The Board of Directors is a qualified person with various skills, knowledge, expertise, and experiences that benefits the Company’s business operation. The Board of Directors has been appointed from shareholders to determine the Company’s vision, mission, long-term goals, and corporate governance and business ethics rules. The Board of Directors also holds responsibility in appointing the Executives to be responsible for business operation and supervising and monitoring the Executives works to be by the decided goals and policies efficiently and effectively. The Board of Directors also appoints the sub-committees to be responsible for the particular assigned task, and the Company Secretary to be responsible for the meetings’ administration. In this regard, the Board of Directors shall perform its duty with knowledge, abilities, transparency, caution, and accountability towards the Company and shareholders. The Board of Directors shall be independent from the Management Department. The policies and guidelines regarding the Board of Directors are as follows:

Board Composition

Qualifications of Directors

The Company has specified qualifications of the Board of Directors as follows:

Qualifications of Independent Directors

According to the Board of Directors Meeting No.7/2011, the Meeting had a resolution to acknowledge the qualification of Independent Directors comply with requirements stipulated by the SEC and the SET. Therefore, the qualification of Company’s Independent Directors shall be as in the followings:

Terms of service of Director Directors

shall hold the terms as stipulated in the Public Limited Companies Act B.E. 2535 and the Company’s Articles of Association, which reads, “At each annual general meeting of shareholders, 1/3 of the directors, or if the number is not a multiple of 3, then the number nearest to 1/3, must retire from office. The directors who have been the longest in office shall retire first. The retiring directors may be re-elected.” The Nomination and Remuneration Committee will select and nominate qualified persons to be directors to the Board of Directors before seeking approval from the shareholders’ meeting.

The Board of Directors has stipulated that members of the Audit Committee, Nomination and Remuneration Committee, Risk Management Committee, and Corporate Governance and Ethics Committee shall each have a term of 3 years and may be re-appointed as deemed fit by the Board of Directors.

Board of Directors’ Meetings

The Board of Directors announced the Board meeting’s schedule in advance for 1 entire year, to the directors and the relevant parties, requiring that a regular meeting be arranged at least once every quarter (4 times a year), with a special session meeting allowed to be convened as deemed necessary. Agenda items are also pre-determined and are clearly divided into categories such as issues for information, issues for approval and issues for consideration.

The Company screens the proposed items to make certain that all crucial issues are included in the agenda, whereas all board members are entitled to propose agenda items independently. The Company Secretary submits an invitation letter complete with the meeting agenda and accompanied by related documents to all board members at least 7 days ahead of the meeting date to allow the board members sufficient time to consider the issues. Where it is deemed essential or urgent, the meeting request can be notified by other method or the meeting can be arranged sooner. A meeting usually takes 1-2 hours. The Company Secretary takes the minutes of the meeting.

To promote the Board of Directors’ performance, the Office of Corporate Secretary determined criteria and forms for the completeness, adequacy and suitability of information submitted to the Board of Directors, aiming to enable the Board of Directors’ meetings to proceed smoothly, quickly and efficiently, in accordance with relevant laws and regulations, for all units concerned to use as reference and standards in preparing information before submitting to the Office of Corporate Secretary for compiling as a proposal to each Board of Directors’ meeting.

In each meeting, the Chairman allows each director to express his/her opinions freely and allocates time appropriately and efficiently. In case of a director having a stake in a matter being considered, the director shall inform the meeting of such stake and shall not participate in discussing the matter and not exercise the voting right on the matter. At least 2/3 of the total number of directors shall be presented to form a quorum at the time of the Board passing a resolution. For each of the Group Executive Committee Meeting, Secretary of the Group Executive Committee was responsible to send out the meeting notice including all agendas to the committee members 7 days prior to the meeting date. All matters discussed in the meetings had been duly recorded in detail and minutes of the meetings were endorsed by the Executive Committee in readiness for inspection by any committee members and related parties.

The Board of Directors encourages each director to attend the Board of Directors regularly, at least 80% of total meetings in the year. In 2021, there were seven Board of Directors’ meetings with a pre-determined schedule. The numbers of the Board of Directors’ meeting, sub-committees’ meeting, shareholders’ meeting, and each director’s meeting attendance are published in “1.2 Meeting attendance and each Directors’ remuneration.”

Besides, the Board of Directors has a policy to encourage non-executive directors, independent directors and members of the Audit Committee to hold meetings among themselves as deemed fit in order to discuss about any crucial management issues without the presence of the management. In 2021, the Board of Directors, held 1 meeting without the executive directors and the presence of the management on February 25, 2021.

(1) Nomination and Appointment of Directors

The Board of Directors assigns the Nomination and Remuneration Committee to determine policies, criteria, and nomination of the Company Directors’ procedures as follow:

Policies and Criteria for the Company Directors’ Nomination

1. Policy and Criteria for Nomination and Appointment of New Directors

1.1 A composition, structure, qualifications and board diversity of the directors to fill any vacancies and/or to fill additional board seats which takes into account the lack of necessary skills on the Board in order to lead the Company to achieve business objectives under management with good corporate governance of international standards.

1.2 A qualified person as per the laws and regulating agencies, and the Company’s announcement.

1.3 A qualified person with knowledge, leadership, courage to express opinions, decision making with information and reasons, morality and ethics, unblemished records.

2. Policy and Criteria for Nomination and Appointment of Current Directors who shall retired by rotation in each year

2.1 Understanding of the Company’s business, meeting agendas, and ability to provide useful information.

2.2 His/Her dedication to the Company, such as meeting attended and activities participation.

Director nomination and appointment procedures

In nominating or selecting directors, the Nomination and Remuneration Committee follows the procedures as follows:

(2) Nomination and Appointment of Executives

The Board of Directors assigns the Human Resources Department to recruit and select qualified persons, i.e., knowledgeable, skillful, experienced, and understanding the required business, then propose to the authorize person for consideration. The nomination and appointment of the Company’s executives shall be in line with the Corporate Authority Index (CAI) and proceeds as approved by the Board of Directors as follows:

New Director Orientation

The Board of Directors recognizes the importance of new director orientation and had adopted a policy and method on this matter as follows:

Succession Plans

The Board of Directors sees the importance and need to support the development of a succession plan for the top executive, Chief Executive Officer and/or other key management positions, which is part of the Company’s human resources management strategy. The Development planning of talented personnel is aimed to cope with any unexpected incapability or vacancy of those key positions to ensure uninterrupted operation.

The Board of Directors’ Meeting No. 1/2019 on February 28, 2019, assigned the Human Resources Department to coordinate and prepare a succession plan for the Group CEO, Top Executives, and/or essential executives positions, and to report the result of the succession plan implementation to the Board of Directors’ Meeting at least once a year.

Merger and Segregation of Duties

The Board of Directors requires that duties be clearly segregated for the purpose of power distribution in decision making and directing, with balance and review in management. This has been continuously improved for suitability and coverage of the Company’s activities, in line with changes in the notification or requirements of regulatory agencies, with management power being put under the Corporate Authorization Index for information and action by parties concerned.

Independence of Board of Directors and Management

1. Segregation of Chairman of the Board position and Group Chief Executive Officer position

As a strong advocate of good corporate governance, the Board of Directors has segregated the positions, powers and duties of the Chairman of the Board and the Group Chief Executive Officer in conformity with the Corporate Authorization Index, which was duly approved by the Board of Directors, so as to ensure the Board of Directors’ independent checks and balances against the management

2. Balance of power

The Board of Directors ensures that it has a proper board composition and definite segregation of roles, duties and responsibilities between the Board of Directors and the management.

All board members have the freedom of conveying their opinions on the Company’s operation with integrity and in the best interest of the Company and without being influenced by any party. They also are held accountable for performing duty in accordance with relevant laws, the Company’s Articles of Association, and resolutions of the Board of Directors’ meeting and the shareholders’ meeting.

Directorship in Other Listed Companies

The Board of Directors has established a policy on directorship in other listed companies as follows:

1. Directorship in other listed company held by the Company’s directors

2. Directorship in other listed company held by Group Chief Executive Officer and Top Management

To bring overall benefit to the Company and not affect their duties and responsibilities. The Group Chief Executive Officer and top executives can hold the director positions of other companies in the Company Group. The Board of Directors specifies that the holding of a directorship in other listed companies of the Group Chief Executive Officer and top executives shall be by the Public Limited Company Act, B.E. 2535.

Suppose the Group Chief Executive Officer and top executives are appointed as directors of companies other than companies in the Group. In that case, the approval process shall follow the Corporate Authority Index (CAI) and proceeds as approved by the Board of Directors.

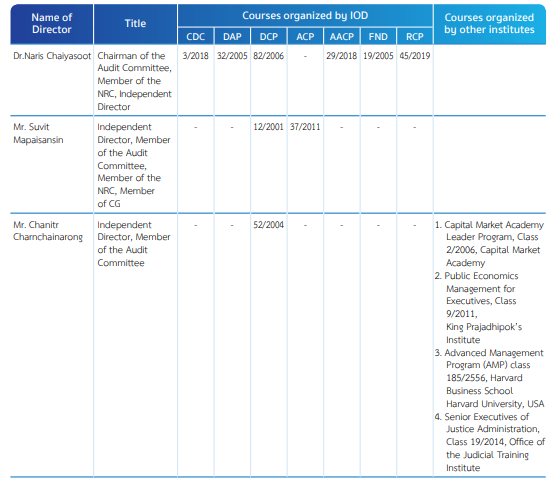

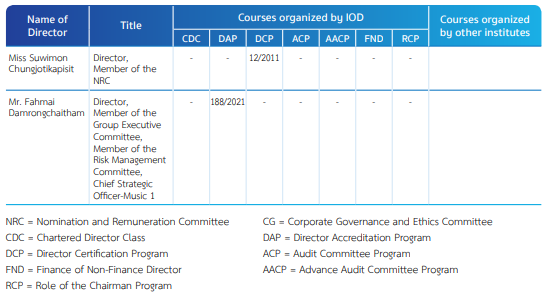

The Board of Directors encourages, supports and provides convenience for all parties concerned with the Company’s corporate governance processes such as directors, sub-committee members, management, Company Secretary, Investor Relations Department, Accounting Department, etc. to participate in training and seminar programs or activities arranged by Thai Institute of Directors (IOD), the SET, the SEC, Thai Listed Companies Association, Thai Investors Association or other independent organizations on a regular and continuous basis in a bid to enhance their knowledge and operational efficiency. The Board of Directors has assigned the Company Secretary to coordinate with the directors and management and inform them of details about the said training courses.

As of December 31, 2021, the Board of Directors and sub-committees attending courses organized by IOD and by other institutions, as tabulated below:

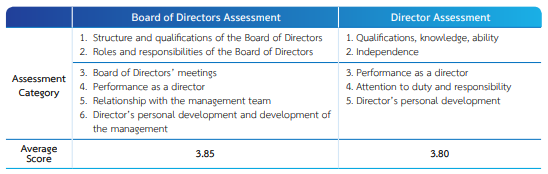

The Board of directors regularly conducts a yearly Board as a whole and Director self-assessment to be used as a framework for evaluating the board’s performance, and consider, review and analyze its performance for further improvement.

Annual Self-Assessment

1. The Board of Directors’ Self-assessment

The Board of Directors regularly conducts a yearly Board and Director self-assessment to be a framework to monitor the performance of the duties of the Board, including reconsider processing commentaries on various issues related to the operations of the Company, and duties of the Board during the past year, a summary of the Company Secretary, and present the findings to the Board of Directors to be used to edit and enhance performance.

The Board self-assessment is divided into 5 rankings: 4 = Excellent, 3 = Very Good, 2 = Good, 1 = Unfavorable, 0 = Need Improvement.

The ranking results of Board self-assessment, broken down into 6 categories, for 2021 were as shown below:

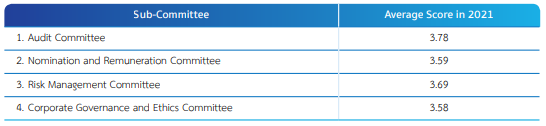

2. The Sub-committees’ Self-assessment

The Board of Directors required that self-assessment apply to all Sub-committees, namely, the Audit Committee, Risk Management Committee, Corporate Governance and Ethics Committee and Nomination and Remuneration Committee. The self-assessment results were reported to the Board of Directors on a yearly basis for review of the committees’ performance, including opinions on issues related to their performance of duties during the past year, with an aim to make improvements and enhance work efficiencies. The performance assessment forms were determined according to each committee’s scope of duties and responsibilities. For the Audit Committee, the performance assessment was also based on the Best Practice Guidelines for Audit Committee, developed by the SET, the Thai Institute of Directors (IOD) and companies with good ratings on good corporate governance, where applicable to the Company.

In 2021, all the Sub-committees performed their duties well with knowledge and abilities in accordance with the scopes of duties and responsibilities given in their respective charters and align with the regulator’s best practice guidelines.

The Company Secretary summarized the results of each Sub-committee’s performance assessment for submission to the Board of Directors at the Board’s Meeting No.2/2022 on February 25, 2022. The Sub-Committees assessment is divided into 5 rankings: 4 = Excellent, 3 = Very Good, 2 = Good, 1 = Unfavorable, 0 = Need Improvement

Results of the self-assessment

3. Group Chief Executive Officer’s Evaluation (Group CEO)

The Board of Directors has assigned the Nomination and Remuneration Committee to evaluate the performance of the Group Chief Executive Officer (“Group CEO”) on a yearly basis, for use as a guide in determining the Group CEPO’s remuneration and submit the result of the evaluation to a meeting of the Board of Directors for acknowledgement and approval.

In 2012, the Nomination and Remuneration Committee agreed to improve the evaluation form of the performance of Group CEO to suit the current situation, based on the evaluation form of the performance of the top executive of the Corporate Governance Center, The Stock Exchange of Thailand.

The Group Chief Executive Officer evaluation is divided into 5 rankings: 4 = Performed excellently, 3 = Performed very well, 2 = Performed reasonably, 1 = Performed partially, 0 = Not yet performed.

The overall evaluation, with total scores of 100%, can be classified into 5 levels:

In 2021, the Nomination and Remuneration Committee evaluated the performance of Miss Boosaba Daorueng, the Group Chief Executive Officer for 2021 and reported to the Board of Directors’ meeting No. 2/2022 held on February 25, 2022, that the overall evaluation of the Group Chief Executive Officer was rated “Very Good”, or equivalent to the average score of 93.99%

Governance of Subsidiaries and Associated Companies

The Board of Directors has established a governing mechanism for subsidiaries and associated companies to monitor and supervise the management and operation of subsidiaries and associated companies. The Company has significantly invested to the extent appropriate to each business. The Company has disclosed its mechanism in governing the subsidiaries and associated companies in “1.3 Supervision of Subsidiaries and Associated Companies’ Operations” on page 133 of Annual Registration Statement / Annual Report 2021 (Form 56-1 One Report)